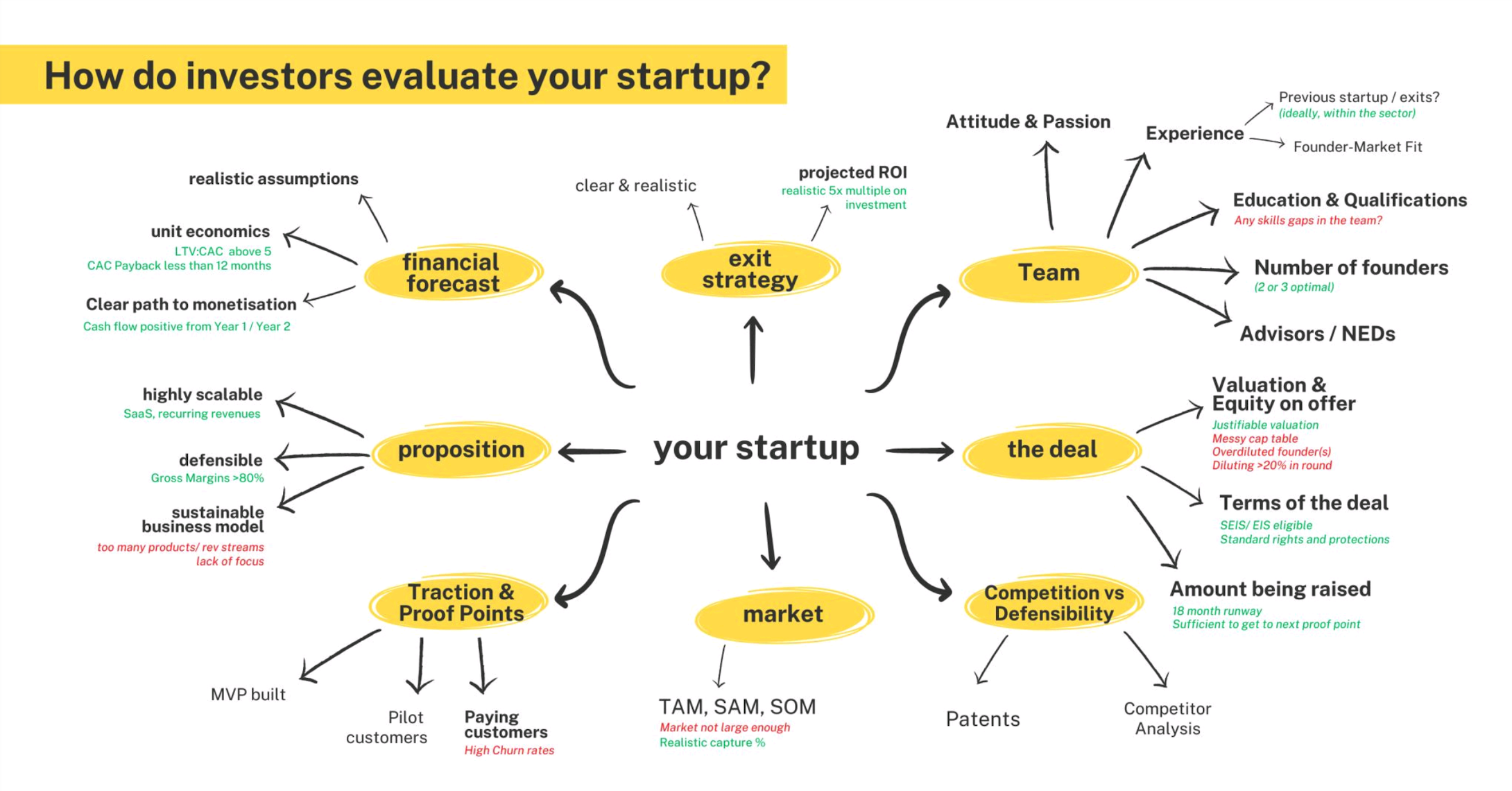

When investors look at a startup, they’re essentially assessing its potential for growth and return on their investment.

Each aspect we’ll look at plays a crucial role in building investor confidence. Understanding these can give you a clearer picture of how to present your startup in the most appealing way possible to potential investors.

Financial Forecast

-Investors expect realistic assumptions regarding unit economics, such as an LTV/CAC ratio above 5 and a CAC payback period of less than 12 months.

-They look for a clear path to monetization with cash flow turning positive by the first or second year.

Exit Strategy

-A clear and realistic exit strategy should be in place, capable of delivering a significant return on investment, ideally a 5x multiple.

Proposition

-The business model should be highly scalable, such as SaaS models with recurring revenues.

-It should be defensible with high gross margins exceeding 80%.

-The business model should be sustainable without spreading resources too thinly across too many products or revenue streams.

Traction & Proof Points

-Market validation should be demonstrated through milestones like building an MVP, acquiring pilot customers, and retaining paying customers with low churn rates.

Market

-A thorough understanding and communication of the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) are critical.

-The market must be large enough and the startup should have a realistic plan to capture a significant market share.

Team

-The experience, qualifications, and founder-market fit of the team are crucial.

-A balanced number of founders and the presence of advisors or Non-Executive Directors (NEDs) enhance the startup’s credibility.

The Deal

-Investment terms, including the valuation and equity on offer, should be justified and attractive to investors.

-The capitalization table should be clean, avoiding over-dilution of equity, especially during the round.

Competition vs Defensibility

-Possessing patents or performing a thorough competitor analysis can significantly strengthen the startup’s market position.

-A unique selling proposition (USP) that clearly differentiates the product from competitors is essential.

Bonus

Here’s the map for you! Focus on the aspects investors like to see (marked in green ✳️), and steer clear of the potential pitfalls (highlighted in red 🔴).