If you’ve got a startup, 2024 is looking exciting! BUT you’ve got to do more than just bring in cash. To secure funding this year, you need to prove people want what you’re selling, have a great team by your side, and grab attention with some big-name customers. 💸

Here’s a snapshot of how 2024 is shaping up for tech startups, especially if you’re in the AI space, according to data from Carta.

▶ Seed Stage (2023)

The seed stage valuations saw a general increase toward the end of 2023, reaching a median of $13.9 million. This was after a period of ups and downs but showed resilience in the face of market challenges.

The final rise indicates that even though fewer deals were happening, the ones that did close were of higher quality, with investors willing to pay more for startups they believed had strong potential.

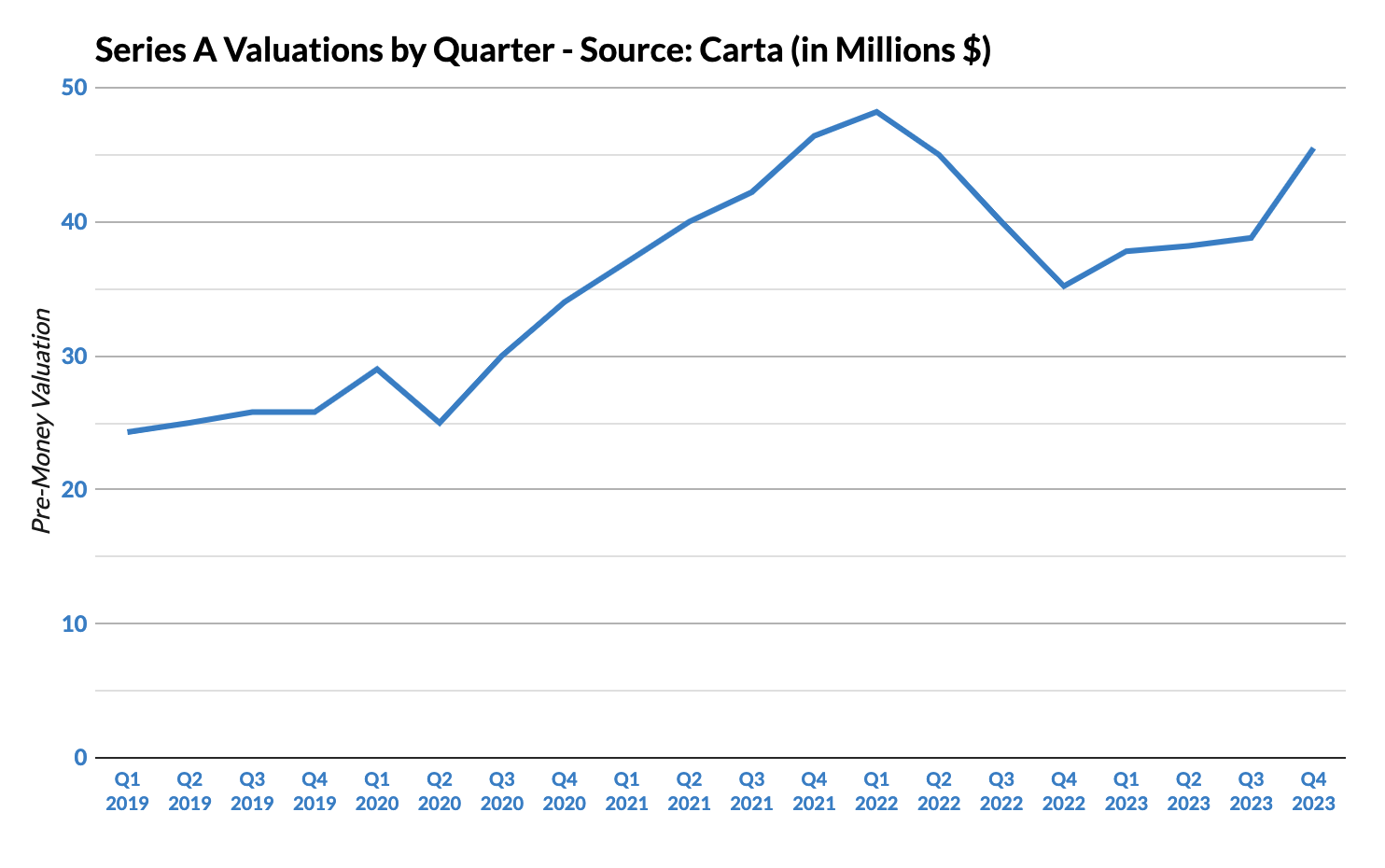

▶ Series A Stage (Q4 2023 & 2024)

The Series A market experienced a peak valuation of $48.2 million in Q1 2022, but then there was a decline throughout the following months. By Q4 of 2023, the valuations had risen again to $45.5 million.

This rebound reflects a market where investors are very interested in startups with solid business models and potential, especially in promising fields like AI and tech, which leads to intense competition for the best deals.

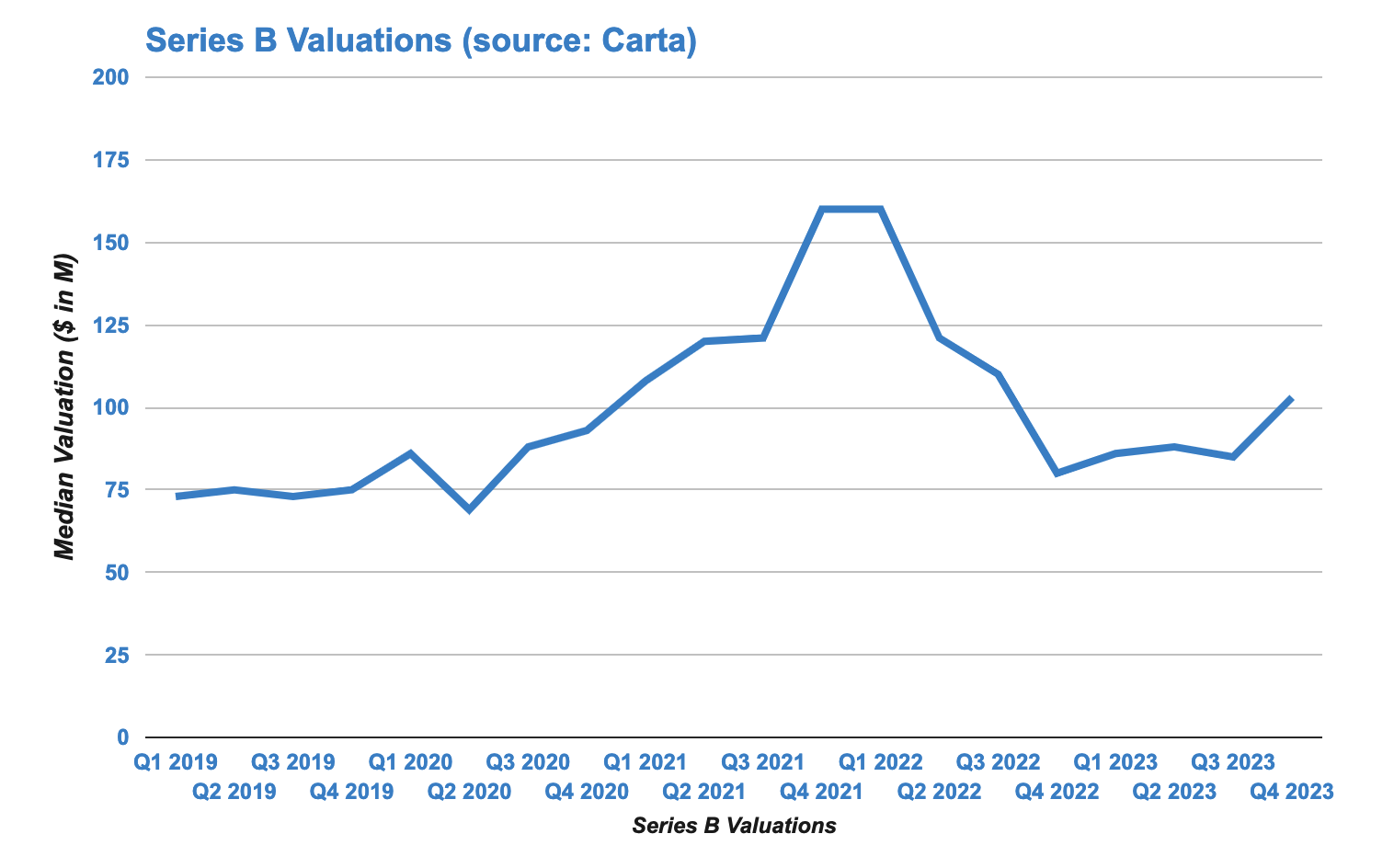

▶ Series B Stage (Late 2023 & 2024)

Series B companies saw an even more dramatic shift. After reaching a high of $160 million in Q1 2022, valuations plunged in the following months, hitting a low of $80 million. However, by the end of 2023, there was a recovery to $103 million.

This volatility showcases the sensitivity of Series B funding to the broader market’s confidence and the changing appetites of investors, who are particularly cautious about where they put their money.

Bottom Line 💰

Throughout these fluctuations, one thing remains clear for startup founders in early 2024- you must remain focused on achieving the milestones that prove your business is on the right track.

This includes not only growing revenue and reaching the expected Annual Recurring Revenue (ARR) for their stage but also demonstrating that there’s a strong market for their product, assembling a capable team, and securing important client endorsements.

These elements are crucial in a competitive market where only the startups that show true promise and capability to scale will be able to secure the necessary funding to move forward.