Unit economics isn’t just investor lingo-it’s a way to prove that your startup can scale quickly. If you nail this, you’ve got a clearer shot at funding.

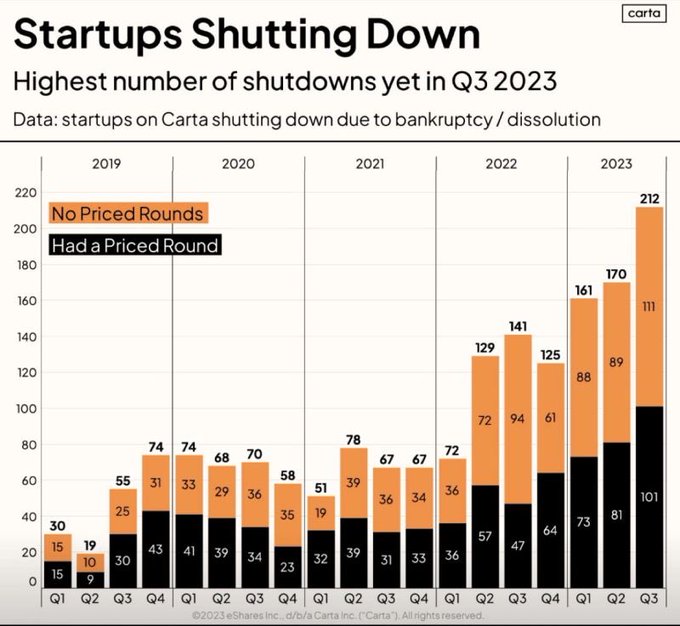

In the past, it was common to raise large rounds of funding through blitz scaling strategies marked by billion-dollar valuations. However, in Q3, 2023 many were confronted that their business is built on faulty unit economics and ran out of money.

Let’s understand the 2 concepts(blitz scaling and unit economics) at a time:

Blitzscaling

It’s a rapid and aggressive expansion of a company to serve a large, often global market with the aim of becoming the first mover at scale. It emphasizes the necessity of moving quickly in the networked age to outpace competition and seize market opportunities.

Blitzscaling involves accepting managerial inefficiencies and burning through capital to achieve rapid growth, often requiring unconventional approaches and heuristics to navigate challenges.

While it can lead to high-impact entrepreneurship and industry transformation, blitzscaling also comes with risks and complexities that need to be carefully managed.

Unit Economics

It’s the measure of the profitability of a business at the unit level—be it a customer, service, or product—before administrative costs are accounted for.

Now there are 2 key KPIs when considering unit economics:

LTV/CAC ratio

It helps to understand the efficiency of marketing and sales efforts.

-LTV (Lifetime Value): Total average revenue a customer will generate (Revenue per Customer * Customer Lifespan) * Gross Margin.

-CAC (Customer Acquisition Cost): Total sales and marketing costs divided by the number of new customers acquired.

You want this ratio to be 3:1 or better.

CAC Payback Period

It indicates how quickly a company recovers the investment made in acquiring a new customer.

CAC Payback Period= CAC dived by Monthly Revenue per Customer

Evidently, the shorter, the better here.

Significance of Customer Profitability Analysis

Beyond LTV/CAC and CAC Payback Period, the most direct measure is customer profitability (‘Y’) which provides a straightforward look at whether a business is making more from each customer annually than it spends on serving and acquiring them.

Customer Profitability (Y-in the image)= Average Revenue per Annum – COGS – CAC.

COGS is the direct expenses incurred in producing or delivering goods and services sold by a business.

Understanding unit economics is crucial, but the ability to interpret and communicate these figures to investors is equally important. Grasp your unit economics and you’ve got the playbook for a successful run.